AI Applications in Finance: 7 Powerful Benefits in 2025

Why AI Applications in Finance Are Reshaping Your Industry

AI applications in finance are redefining everything from fraud detection to customer experience. The market hit $9.45 billion in 2021 and is expanding at 16.5% CAGR, with generative AI alone ready to add $200-340 billion in productivity. More than 54% of large financial firms already deploy AI, and Bank of America’s assistant Erica has logged 1.5 billion+ interactions.

The change is happening faster than most executives anticipated. Goldman Sachs reports that AI could automate up to 300 million jobs globally, with financial services among the most impacted sectors. Yet this disruption brings unprecedented opportunities: JPMorgan Chase saves $12 billion annually through AI-driven automation, while Wells Fargo’s predictive analytics have improved loan approval accuracy by 35%.

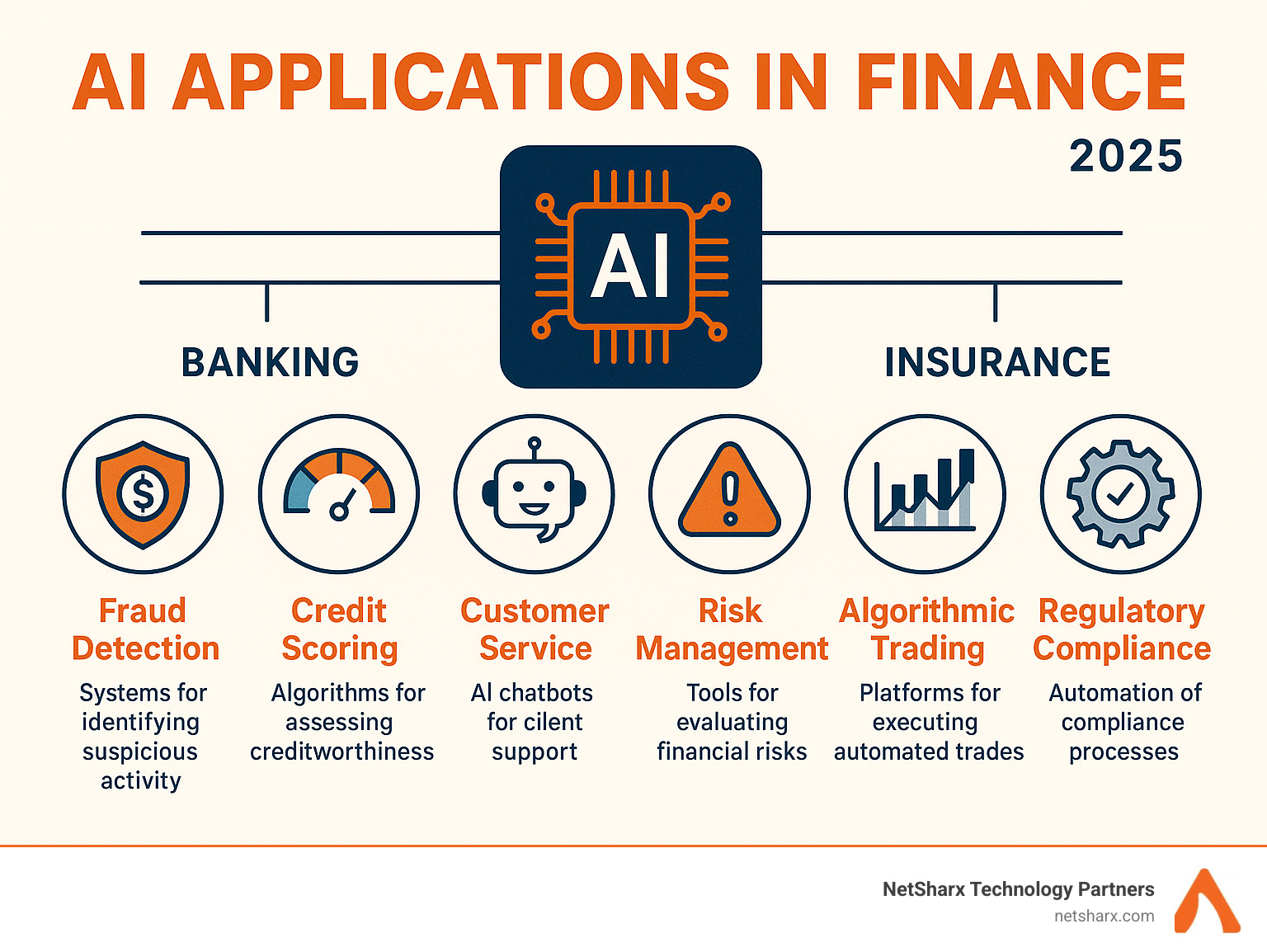

Core use-cases you’ll see throughout this guide:

- Fraud detection & cybersecurity

- Alternative credit scoring

- Hyper-personalized customer service

- Risk management & pricing

- High-frequency and algorithmic trading

- Automated AML/KYC compliance

- Investment research and portfolio optimization

- Insurance claims processing

- Regulatory reporting automation

- Market sentiment analysis

The opportunity is huge, yet most CIOs face a wall of vendor hype and regulatory questions. Traditional financial institutions compete with AI-native fintechs that can approve loans in minutes, detect fraud with 99.9% accuracy, and provide 24/7 customer service at scale. The pressure to innovate has never been greater, but so have the stakes for getting it wrong.

Regulatory scrutiny is intensifying. The Federal Reserve, SEC, and international bodies are developing comprehensive AI oversight frameworks. The EU’s AI Act specifically addresses high-risk AI applications in finance, while the NIST AI Risk Management Framework provides governance guidelines that many institutions are adopting proactively.

You need a clear playbook for what works, what it costs, and how to manage risk while staying ahead of both competition and regulation.

I’m Ryan Carter, CEO of NetSharx Technology Partners. We’ve helped dozens of banks, lenders, and fintechs deploy cloud-based AI to cut costs by 30%+ while enhancing security and CX. Our clients range from community banks implementing their first AI fraud detection systems to global investment firms deploying sophisticated algorithmic trading platforms.

Why This Guide Matters

Your organization now produces millions of data points daily—from mobile transactions to market feeds, social media sentiment to satellite imagery. A single large bank processes over 150 million transactions daily, generating terabytes of structured and unstructured data. Traditional rule-based systems can’t process that volume fast enough or learn from it effectively.

Consumer expectations have evolved dramatically. 89% of consumers rely on mobile banking and demand instant, personalized, and transparent service. They expect their bank to know their spending patterns, predict their needs, and protect them from fraud—all while maintaining privacy and security. The COVID-19 pandemic accelerated digital adoption by an estimated 5-7 years, making AI capabilities essential rather than optional.

Meanwhile, cyber threats are becoming more sophisticated. Financial institutions face 300% more cyberattacks than other industries, with AI-powered attacks requiring AI-powered defenses. Traditional signature-based security systems can’t keep pace with polymorphic malware and advanced persistent threats.

AI meets those expectations but introduces new responsibilities around explainability and ethics. The challenge isn’t just technical—it’s organizational, regulatory, and cultural. This guide distills best practices, pitfalls, and governance models from successful implementations across the industry, so you can innovate with confidence while managing risk appropriately.

What Is Artificial Intelligence in Finance? Pillars and Stakeholders

AI applications in finance use machine learning, deep learning, NLP, and RPA to analyze data, automate tasks, and improve decisions. Think of it as a digital brain that keeps learning.

Key technologies powering today’s use-cases:

- Machine Learning (ML) – Predicts outcomes like default risk by learning from historical data.

- Deep Learning – Neural networks that parse complex, unstructured inputs such as images or handwriting.

- Natural Language Processing (NLP) – Underpins chatbots, sentiment analysis, and document review.

- Robotic Process Automation (RPA) – Software robots that handle repetitive, rules-based work.

Supporting infrastructure spans edge computing for real-time fraud prevention and cloud GPUs for large-scale model training. Regulators such as the SEC and CFTC are drafting oversight frameworks, while corporate boards establish AI governance committees.

The Building Blocks: Data, Models, Infrastructure

- Big-Data Architecture – Cloud data lakes make petabytes of structured and unstructured data searchable.

- Feature Engineering – Data scientists turn raw data into predictive signals (e.g., cash-flow trends for credit scoring).

- GPU-Powered Computing – Parallel processing accelerates both training and inference; cloud makes this affordable.

Key Stakeholders Steering Adoption

- CIOs – Set strategy, choose vendors, balance innovation with compliance.

- Data Scientists – Build, test, and monitor models for accuracy and bias.

- Compliance Officers – Align AI with evolving regulations and ethical standards.

- Customers – Demand speed and personalization but also transparency.

Effective AI projects require tight collaboration among all four groups.

AI Applications in Finance: The Essential Use-Case Playbook

Below are the proven, high-ROI AI applications in finance you can adopt today, with detailed implementation insights and real-world results.

1. Fraud Detection & Cybersecurity

Traditional rule engines trigger too many false positives, often blocking 2-5% of legitimate transactions while missing sophisticated fraud attempts. AI augments them with real-time anomaly detection using hundreds of variables—location, spend patterns, device fingerprints, behavioral biometrics, network relationships, and even typing patterns.

Advanced Techniques:

- Graph Neural Networks analyze transaction networks to identify money laundering rings and coordinated fraud attacks

- Behavioral Biometrics track how users interact with devices—mouse movements, typing cadence, screen pressure—creating unique digital fingerprints

- Ensemble Models combine multiple AI approaches, with each model voting on transaction legitimacy

- Real-time Scoring processes transactions in under 50 milliseconds, enabling instant decisions without customer friction

Implementation Considerations:

- Start with supervised learning on labeled fraud data, then incorporate unsupervised anomaly detection for unknown threats

- Implement feedback loops so investigators can quickly retrain models based on new fraud patterns

- Use explainable AI techniques to help investigators understand why transactions were flagged

- Deploy A/B testing to measure false positive reduction and fraud catch rates

Results: Major banks report 20%+ fewer fraud losses and dramatically lower false-positive rates. Mastercard’s AI system processes 75 billion transactions annually with 99.9% accuracy. For cybersecurity, AI hunts for insider threats and zero-day exploits faster than human analysts, with some systems detecting breaches 200 times faster than traditional methods.

More info about cybersecurity solutions

2. Smarter Credit & Underwriting Engines

ML underwriting represents one of the most transformative applications of AI in finance. Traditional credit scoring relies heavily on credit bureau data, which excludes 45 million Americans with thin credit files. AI expands the data universe dramatically.

Alternative Data Sources:

- Bank account cash flow analysis revealing income stability and spending patterns

- Utility and telecom payment history demonstrating responsibility

- Educational background and employment verification

- Social media activity (where legally permissible) indicating lifestyle stability

- Mobile wallet and digital payment behavior

- Geolocation data showing residence and work stability

- Psychometric assessments measuring financial personality traits

Advanced Modeling Techniques:

- Gradient Boosting algorithms that handle complex, non-linear relationships between variables

- Deep Learning models that automatically find predictive patterns in raw data

- Ensemble Methods combining multiple models to improve accuracy and reduce overfitting

- Time Series Analysis incorporating temporal patterns in financial behavior

Business Impact:

Lenders using AI underwriting report 25% lower default rates while expanding credit access to previously underserved populations. Approval times drop from days to minutes, improving customer experience and reducing operational costs. Some online lenders achieve 90% straight-through processing rates, with human underwriters focusing only on edge cases.

Regulatory Considerations:

AI credit models must comply with fair lending laws, requiring careful bias testing and model explainability. The CFPB has issued guidance on AI in lending, emphasizing the need for adverse action notices that consumers can understand.

3. Hyper-Personalized Customer Experience

Modern customers expect their financial institutions to understand their needs proactively. AI enables this through sophisticated customer analytics and real-time personalization engines.

Conversational AI Capabilities:

- Natural Language Understanding that handles complex financial queries in multiple languages

- Intent Recognition that routes customers to appropriate services or human agents

- Contextual Memory that maintains conversation history across channels

- Emotional Intelligence that detects customer frustration and escalates appropriately

- Voice Biometrics for secure authentication through natural speech

Personalization Engines:

- Next Best Action models that recommend products at optimal moments in the customer lifecycle

- Dynamic Pricing that adjusts rates based on individual risk profiles and market conditions

- Content Personalization that customizes marketing messages, app interfaces, and communication preferences

- Predictive Service that anticipates customer needs before they’re expressed

Omnichannel Integration:

AI systems maintain consistent customer context across mobile apps, websites, call centers, and branch visits. This unified view enables seamless experiences where customers can start interactions on one channel and complete them on another.

Results:

Bank of America’s Erica has handled 1.5 billion+ customer interactions, with 90% of routine inquiries resolved without human intervention. Customer satisfaction scores for AI-assisted interactions often exceed those for traditional channels, while operational costs drop by 40-60% for routine transactions.

4. Algorithmic Trading & Portfolio Management

AI has revolutionized investment management, from high-frequency trading to retail robo-advisors. The sophistication of these systems continues to advance rapidly.

High-Frequency Trading:

- Microsecond Execution using specialized hardware and co-location services

- Market Microstructure Analysis that predicts short-term price movements based on order book dynamics

- Cross-Asset Arbitrage identifying pricing discrepancies across related instruments

- Sentiment Analysis processing news, social media, and analyst reports in real-time

Quantitative Investment Strategies:

- Factor Investing using AI to identify and exploit systematic risk premiums

- Alternative Data Integration incorporating satellite imagery, credit card transactions, and web scraping

- Regime Detection algorithms that adapt strategies to changing market conditions

- Risk Parity optimization that balances risk contributions across portfolio components

Robo-Advisory Platforms:

- Goal-Based Investing that aligns portfolios with specific financial objectives

- Tax-Loss Harvesting that automatically realizes losses to offset gains

- Rebalancing Optimization that minimizes transaction costs while maintaining target allocations

- Behavioral Coaching that helps investors stay disciplined during market volatility

Two Sigma manages $52 billion using AI-driven strategies, while Renaissance Technologies’ Medallion Fund has achieved legendary returns through quantitative methods. Even retail robo-advisors like Betterment and Wealthfront use sophisticated AI to keep fees low while delivering institutional-quality portfolio management.

5. Regulatory Compliance & RegTech

Regulatory compliance represents a massive cost center for financial institutions, with large banks spending $10+ billion annually on compliance activities. AI automation offers significant efficiency gains while improving accuracy.

Anti-Money Laundering (AML):

- Transaction Monitoring that analyzes patterns across multiple accounts and time periods

- Entity Resolution that identifies connections between seemingly unrelated parties

- Suspicious Activity Detection using unsupervised learning to find unusual patterns

- Case Management automation that prioritizes investigations and suggests next steps

Know Your Customer (KYC):

- Document Processing using OCR and NLP to extract information from identity documents

- Sanctions Screening with fuzzy matching algorithms that catch variations in names and addresses

- Adverse Media Monitoring that continuously scans news sources for customer mentions

- Risk Scoring that dynamically adjusts customer risk ratings based on new information

Regulatory Reporting:

- Data Lineage Tracking that ensures audit trails for regulatory submissions

- Automated Report Generation that compiles complex regulatory filings

- Stress Testing models that simulate various economic scenarios

- Model Risk Management frameworks that validate and monitor AI systems themselves

These five categories cover 80–90% of real-world AI ROI in finance and represent the applications most institutions should prioritize for initial implementations.

Benefits, Risks, and Responsible Governance

Tangible Benefits

- Speed & Efficiency – Processes that took days now finish in minutes, cutting operational costs by 20%+.

- Accuracy – AI spots subtle patterns humans miss, improving risk models and reducing fraud.

- 24/7 Service – Always-on chatbots lift customer satisfaction.

- Financial Inclusion – Alternative-data credit scoring opens new markets.

Managing AI Risks

- Model Bias – Historical data can embed discrimination; periodic audits and bias-detection tools are mandatory.

- Explainability – Use interpretable models where regulations require it, and provide human-readable summaries for black-box approaches.

- Data Privacy – Design systems with GDPR-style “privacy by design,” encrypt data in transit and at rest.

- Regulatory Compliance – Regulators expect clear documentation of model logic, data lineage, and controls.

Best-Practice Frameworks

- Security-by-Design – Integrate encryption, access controls, and secure coding from day one.

- Continuous Monitoring – Track model drift, accuracy, and bias; retrain when performance slips.

- Cross-Functional AI Councils – Blend IT, risk, compliance, and business leaders to guide strategy.

- NIST AI RMF – Follow the NIST AI Risk Management Framework for governance and accountability.

Generative AI and the Future of Financial Services

Generative AI—large language models (LLMs), code generators, and AI copilots—adds a transformative new layer of productivity to financial services. Unlike predictive models that analyze existing data, generative AI creates new content, automates complex reasoning, and enables natural language interaction with sophisticated systems.

The technology has evolved rapidly since ChatGPT’s launch. Financial institutions are now deploying enterprise-grade generative AI systems that can:

- Generate Complex Documents – Regulatory reports, investment research, policy documents, and marketing copy

- Code and Query Generation – SQL queries, Python notebooks, data pipelines, and API integrations

- Conversational Analytics – Natural language interfaces that let non-technical staff query complex datasets

- Automated Decision Support – Synthesizing multiple data sources to provide investment recommendations or risk assessments

- Customer Communication – Personalized emails, proposals, and educational content at scale

- Regulatory Interpretation – Analyzing new regulations and translating requirements into actionable policies

McKinsey estimates generative AI could open up $200-340 billion in annual banking value, with the highest impact in customer operations, software development, and risk management.

How Generative AI Redefines Workflows

Investment Research and Analysis:

Generative AI can process thousands of earnings calls, analyst reports, and market data points to produce comprehensive investment research in minutes rather than days. Goldman Sachs has deployed AI systems that generate initial drafts of equity research reports, allowing analysts to focus on higher-value interpretation and client interaction.

Automated Report Writing:

Regulatory reporting, which traditionally requires weeks of analyst time, can now be largely automated. AI systems draft risk reviews, earnings commentary, and compliance reports by synthesizing data from multiple sources and applying regulatory templates. JPMorgan Chase reports 70% time savings on certain regulatory reports through AI automation.

Smart Document Processing:

Generative AI excels at extracting and validating information from complex documents like loan packages, insurance claims, and legal contracts. Unlike traditional OCR systems, these models understand context and can identify inconsistencies or missing information. This capability is particularly valuable for commercial lending, where loan packages often contain hundreds of pages of financial statements, legal documents, and supporting materials.

Conversational Analytics and Business Intelligence:

Perhaps the most transformative application is enabling natural language interaction with complex financial data. Managers can now ask questions like “Which branch saw the highest mortgage growth last quarter?” or “What factors contributed to increased credit losses in our small business portfolio?” and receive instant, accurate answers with supporting visualizations.

Code Generation and Development:

Generative AI accelerates software development by generating code, documentation, and test cases. Financial institutions report 30-50% productivity gains in certain development tasks. This is particularly valuable for regulatory reporting systems, where requirements change frequently and development cycles must be compressed.

Enterprise Implementation Strategies

Pilot Program Approach:

Successful implementations typically start with low-risk, high-value use cases like internal document generation or data analysis. Organizations build confidence and expertise before tackling customer-facing applications or regulatory processes.

Data Security and Privacy:

Generative AI requires careful attention to data governance. Many institutions deploy private cloud instances or on-premises solutions to maintain control over sensitive data. Others use data anonymization and synthetic data generation to enable AI training while protecting customer privacy.

Model Fine-Tuning:

While general-purpose models like GPT-4 provide impressive capabilities out of the box, financial institutions achieve better results by fine-tuning models on their specific data and use cases. This improves accuracy for domain-specific tasks like regulatory interpretation or investment analysis.

Human-AI Collaboration:

The most successful implementations treat generative AI as an augmentation tool rather than a replacement for human expertise. AI generates first drafts, suggests analyses, and automates routine tasks, while humans provide oversight, validation, and strategic direction.

Preparing for the Next Wave

AI Literacy and Training:

Organizations must invest heavily in AI education across all levels. This includes technical training for developers and data scientists, but also practical AI literacy for business users. Employees need to understand how to effectively prompt AI systems, validate outputs, and integrate AI tools into their workflows.

Agile Change Management:

Generative AI capabilities evolve rapidly, with new models and features released monthly. Organizations need agile processes to evaluate, test, and deploy new capabilities quickly while maintaining appropriate risk controls.

Infrastructure Modernization:

Generative AI requires significant computational resources, particularly for training and fine-tuning custom models. Cloud migration becomes essential to access on-demand GPUs and managed AI services cost-effectively. See more info about cloud change.

Ethical AI Frameworks:

Generative AI raises new ethical considerations around content authenticity, bias amplification, and intellectual property. Organizations need comprehensive frameworks for responsible AI use, including guidelines for human oversight, output validation, and bias monitoring.

Regulatory Preparation:

Regulators are developing specific guidance for generative AI in financial services. Organizations should engage proactively with regulators, participate in industry working groups, and develop documentation practices that will support future compliance requirements.

Generative AI represents a paradigm shift comparable to the introduction of personal computers or the internet. It’s not merely an incremental improvement to existing processes—it’s a fundamental change in how knowledge work gets done. Financial institutions that master this technology will have significant competitive advantages in efficiency, innovation, and customer experience.

Frequently Asked Questions about AI Applications in Finance

How does AI improve fraud detection without raising false positives?

Traditional rule-based fraud detection systems generate high false positive rates because they rely on rigid criteria that can’t adapt to changing fraud patterns. AI systems improve accuracy through several mechanisms:

Behavioral Analysis – AI models learn normal behavior patterns for each customer, considering factors like typical transaction amounts, locations, times, and merchant categories. This personalized approach reduces false positives caused by legitimate but unusual transactions.

Ensemble Methods – Multiple AI models work together to evaluate transactions, with each model focusing on different aspects of fraud risk. This ensemble approach improves accuracy while reducing the likelihood of false positives.

Continuous Learning – AI systems continuously update their understanding of fraud patterns as new data becomes available. This adaptive capability helps them stay current with evolving fraud techniques while maintaining low false positive rates.

Contextual Analysis – AI considers broader context beyond individual transactions, including device fingerprinting, network analysis, and historical patterns. This comprehensive view helps distinguish between legitimate and fraudulent activity.

The results are impressive. JP Morgan Chase reports their AI fraud detection system has achieved significant reductions in false positives while improving fraud detection rates. This means fewer legitimate transactions are blocked, improving customer experience while maintaining security.

Can small financial institutions afford enterprise-grade AI solutions?

Cloud computing has democratized access to enterprise-grade AI capabilities, making them affordable for organizations of all sizes. Several factors contribute to this accessibility:

Pay-as-You-Go Pricing – Cloud AI services typically use consumption-based pricing, allowing small institutions to pay only for what they use rather than investing in expensive infrastructure.

Managed Services – Cloud providers offer pre-built AI models and services that eliminate the need for specialized technical expertise. Small institutions can implement sophisticated AI capabilities without hiring data scientists or AI engineers.

APIs and Integration – Modern AI services provide simple APIs that can be easily integrated into existing systems. This reduces implementation complexity and costs.

Vendor Ecosystems – Many fintech companies offer AI-powered solutions specifically designed for smaller financial institutions. These solutions provide enterprise-grade capabilities at accessible price points.

Shared Infrastructure – Cloud platforms allow multiple organizations to share the costs of expensive AI infrastructure, making advanced capabilities affordable for smaller players.

The key is working with technology partners who understand both AI capabilities and the specific needs of financial institutions. At NetSharx Technology Partners, we help organizations identify cost-effective AI solutions that deliver measurable business value without breaking the budget.

What skills will finance professionals need in an AI-first future?

The future of finance will require a blend of traditional financial expertise and AI fluency. Key skills include:

AI Literacy – Understanding how AI systems work, their capabilities and limitations, and how to effectively collaborate with AI tools. This doesn’t require deep technical knowledge but does need practical understanding of AI applications.

Data Interpretation – The ability to analyze and interpret AI-generated insights, understanding when results are reliable and when human judgment is needed. This includes recognizing potential biases or errors in AI outputs.

Prompt Engineering – For generative AI systems, the ability to craft effective prompts that elicit accurate, relevant responses. This skill is becoming increasingly valuable as generative AI adoption grows.

Ethical Decision-Making – Understanding the ethical implications of AI use in finance, including fairness, transparency, and accountability considerations. This includes the ability to identify and address potential biases in AI systems.

Strategic Thinking – The ability to identify opportunities for AI applications and develop implementation strategies that balance innovation with risk management and regulatory compliance.

Change Management – Skills in managing organizational change as AI transforms traditional processes and roles. This includes communication, training, and stakeholder management capabilities.

Regulatory Knowledge – Understanding evolving regulatory frameworks for AI in finance and ensuring compliance with relevant requirements.

The good news is that these skills can be developed through training and experience. Organizations should invest in comprehensive AI education programs that help employees adapt to the AI-first future while maintaining their domain expertise in finance.

Conclusion

AI applications in finance represent one of the most significant technological changes in the industry’s history. From fraud detection systems that process millions of transactions in real-time to chatbots handling billions of customer interactions, AI has moved from experimental technology to business-critical infrastructure.

The statistics speak for themselves: the AI finance market is growing at 16.5% annually, major banks report 20% reductions in fraud through AI systems, and generative AI could add $200-340 billion annually to global banking productivity. These aren’t future possibilities – they’re current realities delivering measurable business value.

However, success with AI requires more than just technology implementation. It demands careful attention to governance, risk management, and ethical considerations. Organizations must balance innovation with responsibility, ensuring AI systems are fair, transparent, and compliant with evolving regulatory requirements.

The future belongs to organizations that can effectively harness AI while maintaining human oversight and ethical standards. This requires comprehensive strategies that address technology, people, processes, and governance in an integrated approach.

At NetSharx Technology Partners, we understand these challenges because we’ve helped dozens of organizations steer AI implementations successfully. Our unbiased solution engineering approach ensures you get the right technologies for your specific needs, not just the latest trends.

We don’t represent any single vendor or technology platform. Instead, we evaluate your current capabilities, understand your business objectives, and design solutions that deliver measurable results. Our extensive provider network gives us access to the best AI technologies and services, while our comprehensive support ensures successful implementation and ongoing optimization.

Whether you’re just beginning to explore AI applications in finance or looking to scale existing implementations, we provide the expertise and support you need to succeed. Our team combines deep technical knowledge with practical business experience, helping you avoid common pitfalls while maximizing the value of your AI investments.

The AI revolution in finance is accelerating, and the organizations that act now will have significant competitive advantages. Don’t let this opportunity pass by. Contact NetSharx Technology Partners today to learn how we can help you harness the power of AI while managing risks and ensuring compliance.